GLAD TIDINGS of great joy!

Together with promised grants, pledges and tax recovered from Gift Aid....

we have now received enough to pay for restoration of the murals.

The firm undertaking the work hopes to commence in 'the summer'.

Many thanks to all who have so generously contributed.

Below is material that gives an idea of the project that we have been undertaking

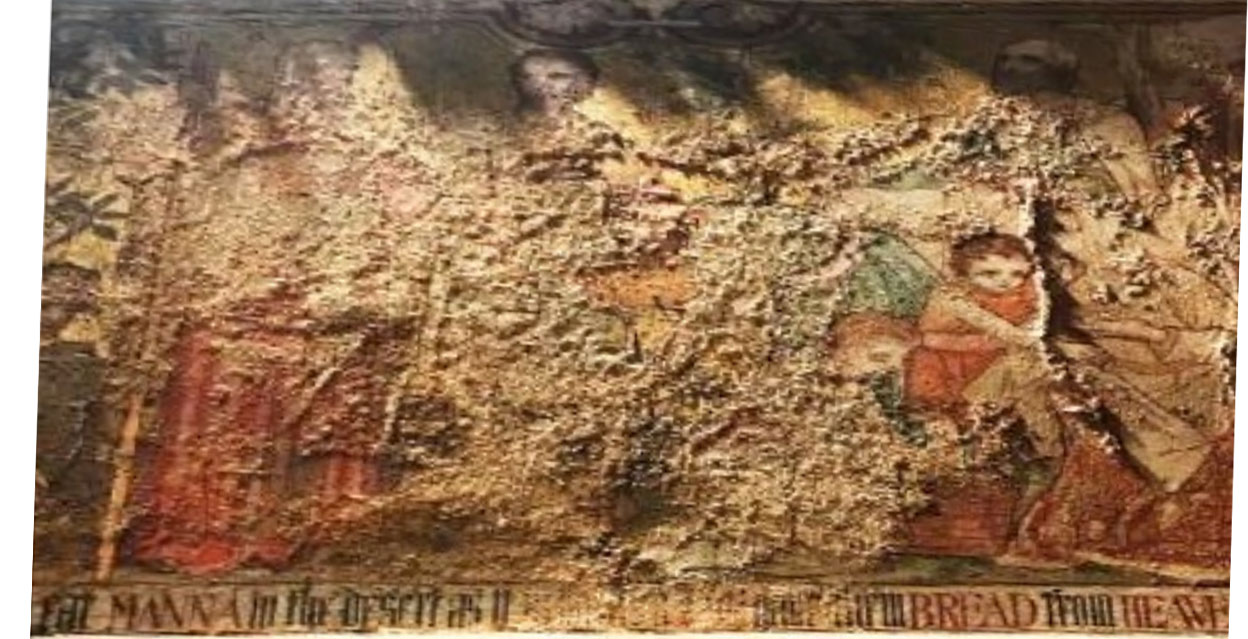

This picture was taken before we started to restore these wonderful murals.

We are working to restore them. As of January 2023

the contributions and promises amount to £24,000.

This means that we are 43% of the way there.

A generous member of the congregation has made us an extraordinary offer. Whatever is raised between 1 st June and 31 st December they will match, up to a limit of £10,000. This presents us with

an opportunity to try to raise most of the required funds by the end of the year. Please consider how you might be able to meet this challenge.

Please contact Alan Keeler or John Beale if you want to know more.

Water seeped in causing material in the roof to deteriorate and salts in the wall to expand to displace pigments. The damage is across most of the North wall of the chancel and also affects some of the ceiling panels above that wall and was first noticed in 2016.

The cause of the water damage eventually traced to poor guttering. This was rectified in 2018 but it has taken a long time for the walls to fully dry, but now we can start on the actual restoration of these lovely murals.

We have obtained advice and a quotation from restoration experts recommended by the Diocesan architects, but much work is needed. Two phases are involved. A grant of £4,000 from the Church of England Church Care Council plus £2,500 from church reserves have allowed us to stabilise the remaining paint and wall surface (phase 1). We plan to ask them for a second grant, to actually restore the paintings (phase 2). That would be for up to their maximum of £10,000, so we are also looking for other potential grants. We will need about £55,000 (including VAT and scaffolding) to complete the work.

We have already applied for grants and we hope to apply for further grants. We also hope that the congregation will contribute to paying for the restoration of these once beautiful parts of our shared heritage. and we will organise fundraising events

We would be very grateful for any donation you feel able to make.

If you would like to know more or become involved in helping with fundraising events contact Alan Keeler, Clem Sutton or John Beale.

How to donate:

By Bank Transfer to the church account –St Marys Plaistow PCC, 60-04 -02 42417198, using the reference “Murals Fund”.

By cash or cheque – put in a retiring collection or sent to the Treasurer, Jill Atkinson, 8 Sandringham Rd, Bromley, BR1 5AS. Cheques should be made to “St Marys Plaistow PCC.” Please indicate that the money is for the “Murals Fund”.

By using the SumUp machine at the back of church during & after services – this takes a payment from your credit card. However, in this case, please also send a message to the treasurer - jilleatk@aol.com saying that your gift is for the murals rather than for general church funds.

By using the Donate link on the church website, again saying that you wish your donation to be used for the Murals.

If you are a taxpayer, then please also consider gift aiding your donation, as this makes a big difference to its value. For example, a “tax efficient” donation of £20 results in the church receiving £25. If you have already completed a gift aid declaration, we shall assume this applies to your Murals donation too, unless you tell us otherwise. If not, you could put your donation in a gift aid envelope, or complete a gift aid declaration form – they can be downloaded from the website.

If your gift isn’t eligible for gift aid, charities can now claim for any individual gift up to £30, so if you wish to donate more than that, it would be worth doing so spread over several occasions